When I was in law school, Borders Books in Ann Arbor, Michigan had a reputation as one of the nation's most fabulous independent book stores in the nation, with a headquarters on State Street near the independent movie theater and close to the University of Michigan campus, and a small number of other locations nearby.

Borders was then what the Tattered Cover bookstore in Denver is now.

Meanwhile, discount retailer Kmart, founded in 1962 to fill roughly the niche that Wal-Mart has right now, as the lowest priced big box retailer in the market offering half decent goods, acquired the mall based Waldenbooks chain in 1984. Waldenbooks was a bookstore for people who don't like to read. Almost nothing they sold was written at above then 10th grade reading level. It was like the pharmacy book rack, but bigger.

In 1992, Kmart bought the very dissimilar (by geographically local) Borders Books, on the theory that Kmart could provide the capital for Borders to expand, and Borders could provided books store operating experience that Kmart lacked. Borders expanded dramatically, Borders and Waldenbooks were merged in 1994, and neither chain was a good fit with Kmart so they were spun off in 1995. Kmart did half a dozen similar deals in other areas (e.g. Office Max. Sports Authority and Payless Drugs) at roughly the same time.

Kmart's deteriorating (and still shabby) core business fell into a Chapter 11 bankruptcy in 2002, left bankruptcy in 2003, and merged with Sears in 2004. Both the Kmart and Sears brands continue to operate struggling big box retail store operations, although market watchers suspect that the real value in the companies may be in their vast real estate holdings which have slowly been converted to other uses (including store within a store Land's End outlets at Sears stores).

Anyway, Borders Group has continued on its merry way for more than 13 years, painstakingly moving Waldenbooks upmarket so that they are smaller but nice mall based mini-Borders stores with a focus on popular titles, while expanding the Borders model to most metro areas in the United States until it has become the number two brick and mortar bookseller in the United States with the entire group having 27,000 employees.

But, the 2009 financial crisis was not kind to Borders group. Its sales covered only about 80% of its expenses. Its full speed ahead expansion has never really been tested either, until now. From shopping there, online and off, I know that its prices are competitive with competitors Barnes & Noble and Amazon.com, although sometimes ever so slightly higher. Anyway, the bottom line is that it has no real room to improve the bottom line by increasing prices. It has spent early 2009 slashing management costs and unprofitable operations, like a marquee downtown Chicago store, and has so far held onto enough financing to keep it afloat.

But, investors have lost faith. The current stock price of 58 cents a share is down from a 52 week high of $10.66 a share. This collapse basically has taken place from September of 2008 until January of this year. The company's market capitalization is now about $36 million.

This is despite the fact that the balance sheet of the company doesn't look all that bad. Its inventory of books and other media to sell are mostly financed with trade credit. Its plant and equipment are almost completely financed with short term debt and capital leases. It has almost no long term debt, and it does have some cash on hand. Still, if you make a loss of 25% of the sale price on everything you sell, you've got a problem.

It looks to me like the losses are basically a case of (1) stores that are too large and have too much overhead to support their sales, and somewhat related (2) too little focus on titles that sell.

Recent experience has also shown a very poor track record for retail companies trying to emerge successfully reorganized from Chapter 11 bankruptcy. So, unless Borders can slash costs, maintain cash flow until the 2009 Christmas season, and have much better sales in 2009 than it did in 2008, it is doomed. This is a shame because Borders really is the best non-independent brick and mortar book seller in the market.

Pages

▼

27 February 2009

What's Left When the Financial Crisis Is Over?

A newspaper dies today (The Rocky Mountain News), an automobile manufacturing division's demises was announced earlier this month (Saturn), an investment bank went bankrupt late last year (Lehman Brothers), so did some major commercial banking institutions (Washington Mutual, Wachovia), as well as hosts of lesser known names, printing companies, home building companies, electronics chains (Circuit City), department shore locations, and franchise restaurants.

More businesses, for example, thousands of car dealerships, are simply biding time until their demise. Corporate giants like Citibank, General Motors, General Electric, the New York Times and Borders Group have seen their stockholders virtually wiped out, and their bondholders have grown insecure.

The business assets that remain are changing hands in a blur. In the garbage industry, collection company BFI was bought by Allied Waste, only to have Allied Waste acquired by Republic Services before the logos on the BFI operations were changed. After thift World Savings was bought by Wachovia, they continued putting up Wachovia signs weeks after Wachovia was gobbled up by Wells Fargo. Wild Oats has irrevocably vanished into the folds of Whole Foods, even though the judiciary, after the merger was a fait accompli, cried "oops!" the merger actually shouldn't have been permitted in light of FTC objections.

When the Great Recession finally bottoms out, we are almost certain to emerge with vast numbers of jobs eliminated, many business enterprises discontinued, reduced competition in most industries, and a major rearrangement of who owns which significant assets. Whole industries like subprime lending and independent investment banking, will virtually cease to exist. Many members of the superrich elites that emerged in the last generation will have seen their fortunes evaporate to the level of mere prosperous families just above the ranks of the upper middle class.

We will also have the legacy of legislation passed to address the current crisis. Some of it, like stimulus packages, will quickly be spent and leave only a precedent for lawmakers in some future crisis. Other legislation, like mortgage broker regulation, rejiggered foreclosure timelines, and a deduction for private mortgage insurance are likely to persist.

Companies that had the capacity to self-finance will likely have done far better than those reliant upon big banks and the financial markets for their operating funds, as will generally, less leveraged companies. Housing will be more affordable.

The percentage of people who have experiences with marred credit and experiences with unemployment payments and/or welfare, will soar. Even more will have run up consumer debts that they incurred to maintain a standard of living in hard economic times, and will need to pay before they can consume what they earn or invest significantly. Many people will have given up their homes and become renters. Millions will have been forced to change careers, usually to less well paying ones.

More closets will be full of thrift store goods, instead of designer clothes. Many people will have taken a shot at growing some of their own food in their backyards (a trend that will likely vanish as a recovery dawns). Distrust of the stock market will persist for a generation. People who started working when I did have not made a dime of nominal investment returns, and have lost a good share of our investments once taxes and inflation are considered. Prospective business owners, meanwhile, will be keen to avoid debt that could ruin them if the economy takes another downward turn.

Veterans who served in Iraq and Afghanistan will finish their terms and return to the U.S., finding themselves in a country that thanks rather than jeers them, but has few jobs to offer. Many of those veterans will be changed men and women as a result of their experiences, in ways that make returning to their families and to the civilian economy particularly hard.

There will probably be a baby bust for a few years.

The aftermath of the Great Recession will vary a lot regionally. The continued demise of the American automobile indusry will hit the rust belt with a stern blow that may finally cause the region to hit bottom with permanent deep contractions of the industrial economy there, but it isn't clear that the new factories in the American South attracted to lower labor costs and weaker pro-union sentiments have taken nearly so heavy a blow, they may recover. New Orleans, as a result of this financial crisis, is far less likely to ever really recover from Hurricane Katrina as some had hoped initially.

Areas that have seen major real estate bubble collapses, like California, Arizona, Nevada and Florida may take a decade or more to recover in the real estate and construction areas. But, increased affordability may restore some of the economic vitality that higher housing prices had sapped out of those economies.

New York City will take time to get back on its feet with the slippage in the financial industry that drives much of its economy -- the city's recently acquired cleaner and safer image may slip back to the darker days of its history. But, if we return to a boom state, this could turn around on a dime.

Other areas will be comparatively unscathed. Seattle, Portland, Boston and Denver have received only glancing blows compared to many regions in the United States.

The agricultural economy has been mostly spared, arrested sprawl has reduced disruption to rural areas at the urban fringe, and the New Energy Economy, with biofuels and wind power as two key components, will provide new revenue streams to many who previously relied only upon food and textile oriented agriculture.

Private sector unions come out much worse, despite that fact that the current administration will probably make many union favorable legal and regulatory changes. Hard economic times have forced almost every union shop in the country to come to the bargaining table at which labor has had to make concessions. Some of the industries shedding jobs, like the automobile industry and newspapers, have high unionization rates (although others, like the jobs lost in the financial sector and car sales, do not, and still others, like construction, are a mixed bag). There are existing indusries, like the service industry, in the private sector where union organizing will speed up. But, few people expect big job growth in the union dominanted private indusry industrial sector after we start to recover.

Relatively few job cuts have come in the public sector, although it hasn't been enitrely spared.

This will continue the long standing trend in which public sector unions make up a large and growing percentage of the total labor movement. This could move the union movement upscale socio-economically. Historically, Americans have tended to think about unions as working class institutions united against "capitalists." But, increasingly unions represent securely middle class workers from fickle and sometimes incompetent political masters. They buffer workers against public outrage. The working class are increasingly working in non-union shops, not infrequently stringing together several part-time jobs in the personal services and retail industries.

In the charitable sector, the collapse of market and real estate based wealth may make grass roots and volunteer based organizations increasingly important relative to long established endowment based grant writing institutions and "checkbook organizations" that have massive fundraising operations that use their funds to forward centralized, professionalized core organizations. Private colleges and universities that have relied upon endowments to subsidize operations will have to increase their tuition and reduce financial aid, even at the cost of reduced selectivity, a change that increased federal government support for higher education is likely to only partially offset.

I don't have a crystal ball, but not knowing everything doesn't mean that you don't know something. Better to start with what seems probable and likely and acknowledge that we aren't sure how it all fits together, than to speculate wildly and with no basis at all.

More businesses, for example, thousands of car dealerships, are simply biding time until their demise. Corporate giants like Citibank, General Motors, General Electric, the New York Times and Borders Group have seen their stockholders virtually wiped out, and their bondholders have grown insecure.

The business assets that remain are changing hands in a blur. In the garbage industry, collection company BFI was bought by Allied Waste, only to have Allied Waste acquired by Republic Services before the logos on the BFI operations were changed. After thift World Savings was bought by Wachovia, they continued putting up Wachovia signs weeks after Wachovia was gobbled up by Wells Fargo. Wild Oats has irrevocably vanished into the folds of Whole Foods, even though the judiciary, after the merger was a fait accompli, cried "oops!" the merger actually shouldn't have been permitted in light of FTC objections.

When the Great Recession finally bottoms out, we are almost certain to emerge with vast numbers of jobs eliminated, many business enterprises discontinued, reduced competition in most industries, and a major rearrangement of who owns which significant assets. Whole industries like subprime lending and independent investment banking, will virtually cease to exist. Many members of the superrich elites that emerged in the last generation will have seen their fortunes evaporate to the level of mere prosperous families just above the ranks of the upper middle class.

We will also have the legacy of legislation passed to address the current crisis. Some of it, like stimulus packages, will quickly be spent and leave only a precedent for lawmakers in some future crisis. Other legislation, like mortgage broker regulation, rejiggered foreclosure timelines, and a deduction for private mortgage insurance are likely to persist.

Companies that had the capacity to self-finance will likely have done far better than those reliant upon big banks and the financial markets for their operating funds, as will generally, less leveraged companies. Housing will be more affordable.

The percentage of people who have experiences with marred credit and experiences with unemployment payments and/or welfare, will soar. Even more will have run up consumer debts that they incurred to maintain a standard of living in hard economic times, and will need to pay before they can consume what they earn or invest significantly. Many people will have given up their homes and become renters. Millions will have been forced to change careers, usually to less well paying ones.

More closets will be full of thrift store goods, instead of designer clothes. Many people will have taken a shot at growing some of their own food in their backyards (a trend that will likely vanish as a recovery dawns). Distrust of the stock market will persist for a generation. People who started working when I did have not made a dime of nominal investment returns, and have lost a good share of our investments once taxes and inflation are considered. Prospective business owners, meanwhile, will be keen to avoid debt that could ruin them if the economy takes another downward turn.

Veterans who served in Iraq and Afghanistan will finish their terms and return to the U.S., finding themselves in a country that thanks rather than jeers them, but has few jobs to offer. Many of those veterans will be changed men and women as a result of their experiences, in ways that make returning to their families and to the civilian economy particularly hard.

There will probably be a baby bust for a few years.

The aftermath of the Great Recession will vary a lot regionally. The continued demise of the American automobile indusry will hit the rust belt with a stern blow that may finally cause the region to hit bottom with permanent deep contractions of the industrial economy there, but it isn't clear that the new factories in the American South attracted to lower labor costs and weaker pro-union sentiments have taken nearly so heavy a blow, they may recover. New Orleans, as a result of this financial crisis, is far less likely to ever really recover from Hurricane Katrina as some had hoped initially.

Areas that have seen major real estate bubble collapses, like California, Arizona, Nevada and Florida may take a decade or more to recover in the real estate and construction areas. But, increased affordability may restore some of the economic vitality that higher housing prices had sapped out of those economies.

New York City will take time to get back on its feet with the slippage in the financial industry that drives much of its economy -- the city's recently acquired cleaner and safer image may slip back to the darker days of its history. But, if we return to a boom state, this could turn around on a dime.

Other areas will be comparatively unscathed. Seattle, Portland, Boston and Denver have received only glancing blows compared to many regions in the United States.

The agricultural economy has been mostly spared, arrested sprawl has reduced disruption to rural areas at the urban fringe, and the New Energy Economy, with biofuels and wind power as two key components, will provide new revenue streams to many who previously relied only upon food and textile oriented agriculture.

Private sector unions come out much worse, despite that fact that the current administration will probably make many union favorable legal and regulatory changes. Hard economic times have forced almost every union shop in the country to come to the bargaining table at which labor has had to make concessions. Some of the industries shedding jobs, like the automobile industry and newspapers, have high unionization rates (although others, like the jobs lost in the financial sector and car sales, do not, and still others, like construction, are a mixed bag). There are existing indusries, like the service industry, in the private sector where union organizing will speed up. But, few people expect big job growth in the union dominanted private indusry industrial sector after we start to recover.

Relatively few job cuts have come in the public sector, although it hasn't been enitrely spared.

This will continue the long standing trend in which public sector unions make up a large and growing percentage of the total labor movement. This could move the union movement upscale socio-economically. Historically, Americans have tended to think about unions as working class institutions united against "capitalists." But, increasingly unions represent securely middle class workers from fickle and sometimes incompetent political masters. They buffer workers against public outrage. The working class are increasingly working in non-union shops, not infrequently stringing together several part-time jobs in the personal services and retail industries.

In the charitable sector, the collapse of market and real estate based wealth may make grass roots and volunteer based organizations increasingly important relative to long established endowment based grant writing institutions and "checkbook organizations" that have massive fundraising operations that use their funds to forward centralized, professionalized core organizations. Private colleges and universities that have relied upon endowments to subsidize operations will have to increase their tuition and reduce financial aid, even at the cost of reduced selectivity, a change that increased federal government support for higher education is likely to only partially offset.

I don't have a crystal ball, but not knowing everything doesn't mean that you don't know something. Better to start with what seems probable and likely and acknowledge that we aren't sure how it all fits together, than to speculate wildly and with no basis at all.

26 February 2009

Last Rocky Mountain News Tomorrow

The last edition of the Rocky Mountain News is tomorrow (citing the Rocky Mountain News). The paper was owned by E. W. Scripps Co. Denver will now be a one [major] newspaper town.

Readers: This may impact links in this blog. Beyond my control. Sorry.

The closure was done in bad form.

The closure took place just a few weeks before the symbolically important 150th anniversary of the paper this April.

Scripps isn't even finishing out a complete week, leaving the city with no one running any newspaper on Saturday, unless the Denver Post creates a Saturday edition for the day after tomorrow on an emergency basis. Do the guys at Scripps even realize that?

There was also no advanced communications to hundreds of thousands of subscribers who have partially paid subscriptions and they have had no opportunity to make alternate newspaper arrangements.

Finally, the timing indicates a deep and unfounded lack of trust from management towards a loyal group of newsroom staff would run the paper responsibily with advanced notice of a closure, in order to preserve their own reputations.

I would think that E.W. Scripps, as a newspaper company continuing to do business in other markets, would ahve more self respect.

UPDATE: The Denver Post is starting a Saturday edition starting this week, and Rocky Mountain News subscribers will get the Denver Post whether they want it or not. Most advertisers will pay the same rates, but not necessarily all of them. From Elevated Voices (the 5280 blog). The Denver Post has also hired a number of the "stars" from the Rocky Mountain News, mostly columnists.

[C.E.O. of Scripps Rich] Boehne said there was an out-of-state nibble from only one potential buyer, who withdrew after realizing that it would cost as much as $100 million "just to stay in the game."

Scripps said it will now offer for sale the masthead, archives and Web site of the Rocky, separate from its interest in the newspaper agency. . . . Staffers were told to come in Friday to collect personal effects.

Readers: This may impact links in this blog. Beyond my control. Sorry.

The closure was done in bad form.

The closure took place just a few weeks before the symbolically important 150th anniversary of the paper this April.

Scripps isn't even finishing out a complete week, leaving the city with no one running any newspaper on Saturday, unless the Denver Post creates a Saturday edition for the day after tomorrow on an emergency basis. Do the guys at Scripps even realize that?

There was also no advanced communications to hundreds of thousands of subscribers who have partially paid subscriptions and they have had no opportunity to make alternate newspaper arrangements.

Finally, the timing indicates a deep and unfounded lack of trust from management towards a loyal group of newsroom staff would run the paper responsibily with advanced notice of a closure, in order to preserve their own reputations.

I would think that E.W. Scripps, as a newspaper company continuing to do business in other markets, would ahve more self respect.

UPDATE: The Denver Post is starting a Saturday edition starting this week, and Rocky Mountain News subscribers will get the Denver Post whether they want it or not. Most advertisers will pay the same rates, but not necessarily all of them. From Elevated Voices (the 5280 blog). The Denver Post has also hired a number of the "stars" from the Rocky Mountain News, mostly columnists.

Global Warming: How Much? How Soon?

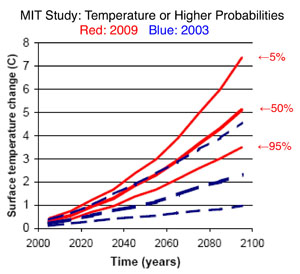

So, what does this graph say? It says that in a business-as-usual ("no policy") scenario, there is a 50% chance that the temperature will 5C (9F) or more warmer in 2095 and there is a 95% chance that it will be 3.5C (6.3F) or more warmer in 2095!

Scientists tell us that going past 2C (3.6F) warmer will be disaster. As I said in my previous post, 2C (3.6F) warming will be really bad, 3C (5.4F) will be biblical, and at 4C (7.2F) and above, we face the possible collapse of agriculture, the economy, and perhaps civilization itself. It may be "Game Over" at 6C (10.8F) and above.

We can see from the graph that there is a 50% chance we will cross the 2C (3.6F) "danger line" between 2040 and 2050, and there is a 95% chance will will cross it by 2060 or before.

From here, citing this report.

The red lines are the current predictions. The blue lines are the predictions made in 2003 by the authors of the current study.

Who would have guessed that air pollution is more likely to do us in than nuclear war or a comet?

25 February 2009

Poodles, Chihuahuas, St. Patrick's Day and Purim

When "Poodle kills Chihuahua at park" makes the online front page headlines in the metro Denver oriented Rocky Mountain News, despite the fact that the incident took place across the mountains in Grand Junction, we may just be having a slow news day. It almost reads like a headline out of The Onion, but The Daily Sentinel, which I subscribed to for three years when I lived in Grand Junction, is a legitimate and serious, albeit underwhelming, newspaper.

It is also set to be a glorious sunny day in Colorado. Maybe we're all just sick of hearing heavier news.

Today is also Ash Wednesday, the first day of Lent for liturgical Christians. Lent, and its Islamic counterpart Ramadan, are extended periods set aside for self-denial in later winter/early spring. Historically, they coincided with the lean days when food stores from fall harvests would run low before spring harvests arrived, in part due to the perennial inability of people to plan well for the future, and in part due to inadequate means of food storage.

In the Lutheran Church I attended growing up, Lent meant Wednesday night church services followed by soup and bread suppers, sometimes a sedar service to familarize us with what Passover involved for Jews like Jesus, the removal of decorations from the sancturary, and giving something up enjoyable and a little decadent for forty days (New Year's Resolutions have been safely abandoned by then). It began with Ash Wednesday annointing with ashes (traditionally from the burning of Palm Sunday palms from the year before), for the truly hard core, and wraps up with an intensely meditative and worship filled Holy Week, and finally with a festive sunrise Easter morning service and candy.

I was pondering, as I noted this date today, why St. Patrick's Day, and the Jewish holiday of Purim, both of which are traditionally observed with heavy drinking, during this period normally reserved for underconsumption.

The fact that Passover and Easter are moveable holidays in our conventional solar calendar (the latter because of the former), somewhat obscures a plausible reason, but this year, St. Patrick's Day, March 17, lies almost exactly halfway into Lent. So, perhaps St. Patrick's Day and Purim served as times to blow up the pent up frustration and crankiness of the midpoint of the lean days of the year.

Lutherans, in practice, believe in not sinning in the first place, perhaps because they banned indulgences and don't fully trust the whole forgiveness concept deep in their hearts. So, we never made all that much of St. Patrick's Day. It is also tainted for me by the memory of one of my high school peers who killed himself after getting drunk with green beer in our college town. Instead, we worried mostly about getting pinched at school if we didn't wear green, a tradition tolerated, and even encouraged by our teachers who normally wouldn't tolerate such mischief. Immediate minor pain for the minor sin of failing to follow the rules of the holiday was a way to recognize the St. Patrick's Day holiday far more in tune with Lutheran and Midwestern sensibilities.

It is also set to be a glorious sunny day in Colorado. Maybe we're all just sick of hearing heavier news.

Today is also Ash Wednesday, the first day of Lent for liturgical Christians. Lent, and its Islamic counterpart Ramadan, are extended periods set aside for self-denial in later winter/early spring. Historically, they coincided with the lean days when food stores from fall harvests would run low before spring harvests arrived, in part due to the perennial inability of people to plan well for the future, and in part due to inadequate means of food storage.

In the Lutheran Church I attended growing up, Lent meant Wednesday night church services followed by soup and bread suppers, sometimes a sedar service to familarize us with what Passover involved for Jews like Jesus, the removal of decorations from the sancturary, and giving something up enjoyable and a little decadent for forty days (New Year's Resolutions have been safely abandoned by then). It began with Ash Wednesday annointing with ashes (traditionally from the burning of Palm Sunday palms from the year before), for the truly hard core, and wraps up with an intensely meditative and worship filled Holy Week, and finally with a festive sunrise Easter morning service and candy.

I was pondering, as I noted this date today, why St. Patrick's Day, and the Jewish holiday of Purim, both of which are traditionally observed with heavy drinking, during this period normally reserved for underconsumption.

The fact that Passover and Easter are moveable holidays in our conventional solar calendar (the latter because of the former), somewhat obscures a plausible reason, but this year, St. Patrick's Day, March 17, lies almost exactly halfway into Lent. So, perhaps St. Patrick's Day and Purim served as times to blow up the pent up frustration and crankiness of the midpoint of the lean days of the year.

Lutherans, in practice, believe in not sinning in the first place, perhaps because they banned indulgences and don't fully trust the whole forgiveness concept deep in their hearts. So, we never made all that much of St. Patrick's Day. It is also tainted for me by the memory of one of my high school peers who killed himself after getting drunk with green beer in our college town. Instead, we worried mostly about getting pinched at school if we didn't wear green, a tradition tolerated, and even encouraged by our teachers who normally wouldn't tolerate such mischief. Immediate minor pain for the minor sin of failing to follow the rules of the holiday was a way to recognize the St. Patrick's Day holiday far more in tune with Lutheran and Midwestern sensibilities.

24 February 2009

Comic Books Profitable

I had always thought that the publishing side of the comic book business was a more or less break even operation whose main value was the opportunity that they provided to cheaply test market ideas that could be easily transformed into movies and merchandise.

Apparently, I was wrong. The publishing side of Marvel Comics, for example, turns out to have a remarkably high 38% operating profit margin.

As these numbers show, comic book sales have proven themselves to be virtually recession proof (which makes sense given that comics books first took off as a media form in the Great Depression). Even in the economically catastrophic fourth quarter of 2008, Marvel's sales were actually up.

In contrast, big time publishing company McGraw-Hill has a roughly 15% margin, earning about $1.0 billion of net income on $6.8 billion of sales in 2007. The comparison isn't precisely apples to apples, but comic books appear to be quite a bit more lucrative than traditional books.

I wonder if the profitability of comic book companies has anything to do with the relative disorganization of comic book writers compared to, for example, screen writers and playwrights, who are almost universally members of unions. So far as I know, there isn't a mangaka's union in the United States, and comic book writers don't command the huge royalties that their Japanese counterparts and best selling American authors in traditional formats do. The dominance of a smaller number of comic publishers in the industry, with Marvel and D.C. Comics overwhelming all other publishers in the comic book industry, could also be a factor. The fairly thin distribution network, since there are far fewer comic book stores than there are book stores, could also be relevant.

Apparently, I was wrong. The publishing side of Marvel Comics, for example, turns out to have a remarkably high 38% operating profit margin.

Marvel’s publishing division finished 2008 with sales of $125.4 million, virtually flat with 2007 when revenue was $125.7 million. Operating profit slipped to $47.3 million from $53.5 million, which the company said was primarily due to ongoing investments in digital initiatives.

As these numbers show, comic book sales have proven themselves to be virtually recession proof (which makes sense given that comics books first took off as a media form in the Great Depression). Even in the economically catastrophic fourth quarter of 2008, Marvel's sales were actually up.

In contrast, big time publishing company McGraw-Hill has a roughly 15% margin, earning about $1.0 billion of net income on $6.8 billion of sales in 2007. The comparison isn't precisely apples to apples, but comic books appear to be quite a bit more lucrative than traditional books.

I wonder if the profitability of comic book companies has anything to do with the relative disorganization of comic book writers compared to, for example, screen writers and playwrights, who are almost universally members of unions. So far as I know, there isn't a mangaka's union in the United States, and comic book writers don't command the huge royalties that their Japanese counterparts and best selling American authors in traditional formats do. The dominance of a smaller number of comic publishers in the industry, with Marvel and D.C. Comics overwhelming all other publishers in the comic book industry, could also be a factor. The fairly thin distribution network, since there are far fewer comic book stores than there are book stores, could also be relevant.

Product Placement and Power

Maybe this is obvious to some people, but it just occurred to me today.

When a television program doesn't have product placements in it, the television network is the one that sells advertisements during that program, and thus, the producers and creative people with an interest in that television show are beholden to some network for the money necessary to pay for the show. These shows are like new associates applying for jobs in law firms who have no special business development connections. Moreover, ultimately, the amount a network is willing to pay for a show is dependent upon what the marketing department thinks it can raise selling ads during the show. Their talents are needed, but the market is based upon bids made by the buyers.

A television program with product placements (the NBC series Heroes is among the most blatant in doing so), interferes with this system. The producers and creative people are dealing directly with the advertisers in a way that they can take with them regardless of the network that the show is aired upon. And, by bringing in revenue as well as costs as part of the package, they have more money available to produce the show and hence provide a superior package and get better pay for stakeholders in creating the show, without reducing the available advertising revenue from the show at all. Indeed, product placements line up easy prospective clients for regular ads for the marketing department, making their job of selling TV ads less valuable. These shows are like lawyers with an established book of business looking to affiliate with a law firm, who can receive compensation for both their talents and their business development contributions.

Creative people have always resisted more than nominal involvement from advertisers in their shows, in a parallel to the newsroom v. business side divide in the newspaper industry. But, somebody's products have to be used in any production with a contemporary setting, and not all of those choices are material to the story. Like Eddie Murphy playing a con man elected to Congress in one of his movies, who suddenly discovers that he can take any position he wants on any issues, and that either way, somebody will want to contribute to his campaign as a result, a television show can get some product placement money for almost any consistent choice of product and doesn't have to go with the highest bidder if it fouls the show.

For the creative people, product placement is much less threatening, when they are the ones in control of the process, rather than networks with whom they have an arms length relationship who see their shows as mere commodities to be bought and sold like different grades of diamonds, and no need to produce a good product day after day or strong incentive improve the quality of the shows that they already have in stock.

Will the next natural step in this process come to pass? Will we reach a point where producers simply buy air time on networks like an infomercial (the ultimately in product placement, of course) does, while generating their own revenues from commercials sold as a package deal with the show itself, cutting out the middle man of the network advertising sales departments? Will the networks themselves devolve into mere auction houses for airtime?

While cable television networks add value by putting together a coherent package of programing in a single place, broadcast television stations, the variety shows of the television industry, have never been coherent packages beyond an occasional evening with a few well paired programs. For the most part, the fact that a television show is on ABC, NBC, CBS, or Fox is simply a matter of business negotiations unrelated to the content, just as the fact that a product ends up getting distributed through CostCo rather than Sam's Club has little to do with the product or the identity of the stores themselves.

It isn't obvious that the business model of offering a mismash of programming on one channel makes sense anymore. Behind the drama of the transition from analog to digital television, the big story that had hidden behind that little story that has attracted media attention is that the switch is irrelevant to most television viewers, who either get cable or satellite television. Faced with a disrupted status quo, some percentage of late adopters of subscription based television won't bother to get converter boxes or new televisions and will simply sign up for cable or satellite TV. Only about 5% of television viewers will be impacted by the switch when it finally happens. Most have cable or satellite TV already. The rest either have newer televisions or have bought converter boxes. In a specialized subscription based television market where consumers have hundreds of channels to choose from, niche channels make more sense than one size fits all channels with no focus.

Wither Local TV News Programming?

Of course, networks do produce a little programming, mostly news, and especially local news. The quality is mostly abysmal, but that is still the primary news source for more people than any other source. And, television news informs (or misinforms) people who are less likely to receive additional information through newspapers, magazines, the Internet and public radio than other news sources, i.e. it has far more people who rely upon their broadcasts as their exclusive news source. This is a source of political influence that greatly exceeds the economic clout networks hold from their ordinary entertainment programming. It isn't obvious whether the local television news business will survive the general decline of broadcast television (a business model which collectively loses market share year after year), and if it does, where it will migrate.

Local news departments on commercial television stations already struggle to produce enough content to fill the time allotted to them (as do local news shows on public television and radio). Fluff, overhyped stories that are little more than headlines, and the never ending police blotters, fire department calls, and court room reports, all remarkably analysis and significance free, fill the modest number of minutes these news crews fill between copious advertising. The only parts of the operation brave enough to have opinions or consider issues at length are the sports reporters and the meteorologists. Much of it is repeated several times a day.

Were local news stations to cut the bloat they insert to fill their allotted show times, and a podcast format might be a good fit, while eliminating the need to pile the opportunity costs of expensive air time on top of the production costs that go into making the show in the first place. Broadcast TV creates an incentive to bloat news coverage to leave more time available for ads. Podcasting creates an incentive to deliver succinct messages and either internally placed or short advertisements, in order to capture surfers limited attention spans. Notably, some of the most popular bloggers, like Atrios, are also exceedingly terse. (Don't worry, I won't be following that trend any time soon.)

It simply must be a lot cheaper to produce only the few minutes of content that you actually have to report upon, and distribute it via the Internet, than it is to produce much longer shows that air in several versions a day, and distribute it via scarce broadcast television signals. Indeed, most broadcast TV stations already podcast their shows, one segment at a time, anyway. The dramatically declining cost of good quality digital video equipment should also make this less product, less money model more viable, because there is less of a need to scale up the size of the news department enterprise in order to cover the equipment costs involved.

Alternately, local news could become a niche of its own, and a single channel could, for example, offer what would historically been local news programming and not considered national stories, to larger audiences, such as the entire Rocky Mountain West, rather than simply a part of Colorado, thereby securing enough content to support an entire channel, or even half of dozen or so regional channels focused on local news.

When a television program doesn't have product placements in it, the television network is the one that sells advertisements during that program, and thus, the producers and creative people with an interest in that television show are beholden to some network for the money necessary to pay for the show. These shows are like new associates applying for jobs in law firms who have no special business development connections. Moreover, ultimately, the amount a network is willing to pay for a show is dependent upon what the marketing department thinks it can raise selling ads during the show. Their talents are needed, but the market is based upon bids made by the buyers.

A television program with product placements (the NBC series Heroes is among the most blatant in doing so), interferes with this system. The producers and creative people are dealing directly with the advertisers in a way that they can take with them regardless of the network that the show is aired upon. And, by bringing in revenue as well as costs as part of the package, they have more money available to produce the show and hence provide a superior package and get better pay for stakeholders in creating the show, without reducing the available advertising revenue from the show at all. Indeed, product placements line up easy prospective clients for regular ads for the marketing department, making their job of selling TV ads less valuable. These shows are like lawyers with an established book of business looking to affiliate with a law firm, who can receive compensation for both their talents and their business development contributions.

Creative people have always resisted more than nominal involvement from advertisers in their shows, in a parallel to the newsroom v. business side divide in the newspaper industry. But, somebody's products have to be used in any production with a contemporary setting, and not all of those choices are material to the story. Like Eddie Murphy playing a con man elected to Congress in one of his movies, who suddenly discovers that he can take any position he wants on any issues, and that either way, somebody will want to contribute to his campaign as a result, a television show can get some product placement money for almost any consistent choice of product and doesn't have to go with the highest bidder if it fouls the show.

For the creative people, product placement is much less threatening, when they are the ones in control of the process, rather than networks with whom they have an arms length relationship who see their shows as mere commodities to be bought and sold like different grades of diamonds, and no need to produce a good product day after day or strong incentive improve the quality of the shows that they already have in stock.

Will the next natural step in this process come to pass? Will we reach a point where producers simply buy air time on networks like an infomercial (the ultimately in product placement, of course) does, while generating their own revenues from commercials sold as a package deal with the show itself, cutting out the middle man of the network advertising sales departments? Will the networks themselves devolve into mere auction houses for airtime?

While cable television networks add value by putting together a coherent package of programing in a single place, broadcast television stations, the variety shows of the television industry, have never been coherent packages beyond an occasional evening with a few well paired programs. For the most part, the fact that a television show is on ABC, NBC, CBS, or Fox is simply a matter of business negotiations unrelated to the content, just as the fact that a product ends up getting distributed through CostCo rather than Sam's Club has little to do with the product or the identity of the stores themselves.

It isn't obvious that the business model of offering a mismash of programming on one channel makes sense anymore. Behind the drama of the transition from analog to digital television, the big story that had hidden behind that little story that has attracted media attention is that the switch is irrelevant to most television viewers, who either get cable or satellite television. Faced with a disrupted status quo, some percentage of late adopters of subscription based television won't bother to get converter boxes or new televisions and will simply sign up for cable or satellite TV. Only about 5% of television viewers will be impacted by the switch when it finally happens. Most have cable or satellite TV already. The rest either have newer televisions or have bought converter boxes. In a specialized subscription based television market where consumers have hundreds of channels to choose from, niche channels make more sense than one size fits all channels with no focus.

Wither Local TV News Programming?

Of course, networks do produce a little programming, mostly news, and especially local news. The quality is mostly abysmal, but that is still the primary news source for more people than any other source. And, television news informs (or misinforms) people who are less likely to receive additional information through newspapers, magazines, the Internet and public radio than other news sources, i.e. it has far more people who rely upon their broadcasts as their exclusive news source. This is a source of political influence that greatly exceeds the economic clout networks hold from their ordinary entertainment programming. It isn't obvious whether the local television news business will survive the general decline of broadcast television (a business model which collectively loses market share year after year), and if it does, where it will migrate.

Local news departments on commercial television stations already struggle to produce enough content to fill the time allotted to them (as do local news shows on public television and radio). Fluff, overhyped stories that are little more than headlines, and the never ending police blotters, fire department calls, and court room reports, all remarkably analysis and significance free, fill the modest number of minutes these news crews fill between copious advertising. The only parts of the operation brave enough to have opinions or consider issues at length are the sports reporters and the meteorologists. Much of it is repeated several times a day.

Were local news stations to cut the bloat they insert to fill their allotted show times, and a podcast format might be a good fit, while eliminating the need to pile the opportunity costs of expensive air time on top of the production costs that go into making the show in the first place. Broadcast TV creates an incentive to bloat news coverage to leave more time available for ads. Podcasting creates an incentive to deliver succinct messages and either internally placed or short advertisements, in order to capture surfers limited attention spans. Notably, some of the most popular bloggers, like Atrios, are also exceedingly terse. (Don't worry, I won't be following that trend any time soon.)

It simply must be a lot cheaper to produce only the few minutes of content that you actually have to report upon, and distribute it via the Internet, than it is to produce much longer shows that air in several versions a day, and distribute it via scarce broadcast television signals. Indeed, most broadcast TV stations already podcast their shows, one segment at a time, anyway. The dramatically declining cost of good quality digital video equipment should also make this less product, less money model more viable, because there is less of a need to scale up the size of the news department enterprise in order to cover the equipment costs involved.

Alternately, local news could become a niche of its own, and a single channel could, for example, offer what would historically been local news programming and not considered national stories, to larger audiences, such as the entire Rocky Mountain West, rather than simply a part of Colorado, thereby securing enough content to support an entire channel, or even half of dozen or so regional channels focused on local news.

23 February 2009

Pundit Accuracy A Question Of Style

At first, [Stanford University research psychologist Philip] Tetlock's ongoing study of 82,361 predictions by 284 pundits (most but not all of them American) came up empty. He initially looked at whether accuracy was related to having a Ph.D., being an economist or political scientist rather than a blowhard journalist, having policy experience or access to classified information, or being a realist or neocon, liberal or conservative. The answers were no on all counts. The best predictor, in a backward sort of way, was fame: the more feted by the media, the worse a pundit's accuracy. . . . The media's preferred pundits are forceful, confident and decisive, not tentative and balanced. They are, in short, hedgehogs, not foxes.

[P]olitical philosopher Isaiah Berlin . . . in 1953 argued that hedgehogs "know one big thing." They apply that one thing (for instance, that ethnicity and language are primal; ergo, any country that contains many ethnic groups will break up) everywhere, express supreme confidence in their forecasts, dismiss opposing views and are drawn to top-down arguments deduced from that Big Idea.

Foxes, in contrast, "know many things," as Berlin put it. They consider competing views, make bottom-up inductive arguments from an array of facts and doubt the power of Big Ideas. "The hedgehog-fox dimension did what none of the other traits did," says Tetlock, who described the study in his 2005 book "Expert Political Judgment": "distinguish more accurate forecasters from less accurate ones" in both politics (will Iraq break up?) and economics (whither unemployment?).

From here, via Newsweek.

Even though "foxes" are more accurate than "hedgehogs," random chance "produces a forecast more accurate than most pundits'. Simply extrapolating from recent data on, say, economic output does even better."

The deeper question is why this should be the case. Readers surely don't try to be deceived by pundits, yet it is popularity with readers that drives a pundit's poularity of pundits with publishers, and hence a pundit's fame. Why should people consistently prefer a cognitive style in people making predictions that is consistently less accurate?

Here's one plausible guess.

Perhaps, in our evolutionary history, the predecessor to the modern pundit was the courtier, i.e. the senior advisor to a group's leader. While leaders may have learned the hard way that hedgehogs do not make better predictors of the future, in the pre-journalistic era, average people had a lot more communication with leaders themselves than people giving advice to leaders.

Democracy is a young form of government. Other than a few ancient Greek city-states, a part of Rome's history, second millenium Iceland, and the gradual democratication of the British state (not really complete until the mid-1800s), there were no democracies until the French and American Revolutions, respectively, in the late 1700s. Urban living, in contrast, is at least twenty times as old.

In a non-democratic state, citizens don't participate in daily decision making that it is the business of pundits to second guess. Citizens stay where they were born, or go into exile with a more attractive leader. They submit to a conqueror, or rebel out of loyalty to their previous leader. (This may also help explain why terrorism and civil war almost always has its roots in questions of the legitimacy of a regime, rather than its policy choices; humans may be hardwired not to violently rebel against decisions they have no opportunity to participate in making.)

In a leader, who makes his own fate to a great extent, it is a virtue to be publicly forceful, confident and decisive, rather than tentative and balanced. The goal of a leader is to motivate people, not to accurately predict the outcome of events they will not play a part in themselves. Leaders with a clear vision may have more success in changing outcomes. There is no evolutionary percentage in knowing that you are going to fail before you do if you can do nothing about it.

Wise leaders, in turn, can formulate their plans, from the tenantive and balanced counsel that they receive in private. Indeed, confidentiality is a central element of the ethics of all professions who make it their business to give advice: lawyers, doctors, psychologists, accountants, and clergy. Even more notably, in the ancient convention in parliamentary regimes, cabinet members in a government are obligated to show a united public face to the public on policy issues, regardless of the views that members have personally expressed in private cabinet deliberations.

The average newspaper reader hasn't caught up with his or her psychological legacy. Most of us hunger for decisive leadership, rather than thinking like kings ourselves.

Bush Appointees Out Of Work

"Only 25 to 30 percent of 3,000 political appointees who served President George W. Bush have found work."

From here.

From here.

Federal Judge From Texas Guilty

A federal judge pleaded guilty Monday to lying to investigators by denying he sexually abused his secretary in exchange for prosecutors dropping five sex-crime charges alleging he groped the secretary and another female court employee.

U.S. District Judge Samuel Kent, the first federal judge charged with a sex crime, also retired, effective immediately, avoiding possible impeachment by Congress.

Kent's guilty plea to obstruction of justice came as jury selection for his trial was to begin.

The jurist, who once shouted in court that he would bring "hordes of witnesses" in his defense, spoke barely above a whisper as he pleaded guilty to lying to a judicial committee investigating the sex-related charges. . . . Kent, 59, had been facing six charges - five related to federal sex crimes and the obstruction charge. Under the plea agreement, prosecutors will seek no more than three years in prison when Kent is sentenced on May 11. Obstruction, a felony, carries a maximum sentence of 20 years in prison and a $250,000 fine.

Kent had vigorously maintained his innocence. DeGuerin had said the judge's conduct with the two women was consensual. . . . Authorities first investigated Kent after McBroom filed a complaint against him in May 2007 and the Judicial Council of the 5th U.S. Circuit Court of Appeals began a probe. . . . The judicial council suspended Kent in September 2007 for four months with pay but didn't detail the allegations against him. It also transferred him to Houston, 50 miles northwest of Galveston, where he had worked since being appointed in 1990. . . .

If he had been convicted of the most serious federal sex crimes charges, Kent could have received a sentence of up to life in prison.

From here.

The judicial branch investigation led to the criminal charges. He admits to lying in the course of the investigation. Sentencing is set for May 11, 2009. Kent was appointed by George H.W. Bush.

Russian Ship Fires On Chinese Merchant Ship

Allegedly, on February 15, 2009, the Russian Coast Guard fired upon a Chinese merchant ship, the New Star, trying to leave a Russian port where a business dispute had been left unresolved. The merchant ship started to sink and eight crew were killed in rough waters abandoning ship, while the eight remaining crew were picked up by the Russian Coast Guard. Video available here.

Somehow, this incident escaped notice in the media accounts I've read and heard since then, despite its seeming significance. Warships don't fire on merchant ships in anger every day.

The whole deal has a Hans Solo fleeing authorities with the Millenium Falcon feel to it, complete with allegations of smuggling on the side. Legally, these kinds of issues are squarely within the world of admiralty, a legal specialty that I've dealt with only once or twice in my career (because the Colorado River is arguably one of the "navigable waters" of the United States and hence subject to admiralty law jurisdiction in connection with business taking place upon it), and then only in tort contexts.

Somehow, this incident escaped notice in the media accounts I've read and heard since then, despite its seeming significance. Warships don't fire on merchant ships in anger every day.

The whole deal has a Hans Solo fleeing authorities with the Millenium Falcon feel to it, complete with allegations of smuggling on the side. Legally, these kinds of issues are squarely within the world of admiralty, a legal specialty that I've dealt with only once or twice in my career (because the Colorado River is arguably one of the "navigable waters" of the United States and hence subject to admiralty law jurisdiction in connection with business taking place upon it), and then only in tort contexts.

20 February 2009

Texas Judge Faces Ethics Charges

Formal judicial conduct proceedings have been commenced by the state's judicial conduct commission against Sharon Keller, the Presiding Judge of the Texas Court of Criminal Appeals (the highest court of appeals in criminal cases in Texas) for deliberately denying a death row inmate due process through administrative maneuvers on the night he was executed, contrary to the ethical rules that apply to judges.

Keller's actions almost certainly hastened the execution of the inmate who was executed based upon the legal circumstances of the case, and Presiding Judge Keller knew that this was what would happen.

Keller faces sanctions up to removal from office for her actions. She has fifteen days to respond to the charges against her. She has so far resisted public demands that she resign, but those demands have never involved official misconduct charges brought through the proper channels. Her term would otherwise under 2012, although she could probably run again. She very likely has absolute immunity from prosecution or civil liability under Texas and federal law. She deserves a far worse sanction than mere removal from office.

Keller isn't the only Texas judge recently in trouble. About thirteen months ago, I linked to a post summing up the highest profile issues:

Texas justice, as usual in criminal cases, is far below international standards of due process. This case is just another example of this fact. Of course, this has a lot to do with the fact that so many of the people of Texas are bloodthirsty cretins (see e.g., here, in the comments, and also here).

Keller's actions almost certainly hastened the execution of the inmate who was executed based upon the legal circumstances of the case, and Presiding Judge Keller knew that this was what would happen.

Keller faces sanctions up to removal from office for her actions. She has fifteen days to respond to the charges against her. She has so far resisted public demands that she resign, but those demands have never involved official misconduct charges brought through the proper channels. Her term would otherwise under 2012, although she could probably run again. She very likely has absolute immunity from prosecution or civil liability under Texas and federal law. She deserves a far worse sanction than mere removal from office.

Keller isn't the only Texas judge recently in trouble. About thirteen months ago, I linked to a post summing up the highest profile issues:

This week, lawyers in Texas are closely following the on-going scandal over the indictment of Texas Supreme Court justice David Medina and his wife for arson and other crimes — indictments later quashed by the prosecutors. Click here

Then there is the expanding criminal investigation of U.S. District Judge Samuel Kent for sexual assault and corruption. Click here

Texas Court of Criminal Appeals Presiding Judge Sharon Keller has been nationally criticized for closing the doors of the clerk’s office to prevent a final death row appeal in violation of court practices. Click here Many are still calling for her removal.

Now, three justices on the Texas Supreme Court are facing serious ethics charges. Click here

The Texas system only recently got over scandals of alleged favoritism, including the state supreme court. Over a decade ago, there was great controversy over how Texas trial lawyers financed the campaigns of Democratic justices and how those justice appeared to favor the same lawyers. A feature on ‘60 Minutes’ in 1989 called “Justice for Sale” helped expose the allegations.In the meantime, Dallas has continued to be hit with criticism for its record number of innocent people cleared by DNA in death row cases[.]

Texas justice, as usual in criminal cases, is far below international standards of due process. This case is just another example of this fact. Of course, this has a lot to do with the fact that so many of the people of Texas are bloodthirsty cretins (see e.g., here, in the comments, and also here).

Comment Moderation

I've deleted quite a few comments recently. A legitimate commenter has nothing to fear. This simply reflect a rise in comment spam with comments not pertinent to the posts in question. I am quite lenient about keeping pertinent comments even if they have arguably spam links buried in a commenter's ID. But, I will not tolerate wholly unrelated or vacuous generic comments (e.g. "great post") whose whole point is exclusively to send you to another commercial site.

Juvenile Justice and Mental Health

The prevalence of mental health disorders among adolescents in the justice system is alarming: federal studies estimate that 50-75% of incarcerated kids have diagnosable mental health disorders and nearly half have substance abuse problems. . . . One study revealed that only 4% of adjudicated adolescents receive a mental health placement.

From here.

19 February 2009

Colorado Amendment 54 Litigation Continues

The Colorado Independent has a lengthy update on the progress of litigation in invalidate Colorado Amendment 54, a "pay to play" measure passed by Colorado voters last November.

Colorado Amendment 54 amends the state constitution in a way that largely precludes not only public contractor businesses, but relatives of public contractors, public sector unions and people affiliated with non-profits that receive state grant money from financial involvement in electoral politics. It also bans public contractors from making campaign contributions in areas broader than simply ballot issues for projects upon which they intend to make bids.

The primary issue in the case is whether these campaign finance restrictions, which must be narrowly tailored to legitimate governmental issues to be valid despite First Amendment protections for free speech, are constitutional. The nexus between many of Amendment 54's requirements and pay-to-play conduct is very weak. Multiple commentators, including yours truly, suggested before voters even approved Amendment 54 that on the merits, Colorado Amendment 54 appears to go beyond what is permitted by the First Amendment.

Multiple collateral issues are also relevant to the case.

The Plaintiffs, like those in all public law cases, must first show that they have sufficient individualized harm from Amendment 54 to give them standing to bring suit, must establish that the issue is ripe for court resolution in the absence of any enforcement action, and must navigate the question of taking on the statute "on its face" which entitles it to more deferential review, or "as applied" which leads to more searching review of the statute's constitutionality but requires a showing that the Amendment has indeed been applied in a particular way. Many suits challenging the constitutionality of statutes and state constitutional provisions, end up delayed, as the litigation concerning Colorado Amendment 41 gift ban did, or dismissed, over these kinds of general public law issues.

Another issue is the Plaintiffs manage to clear these hurdles at the trial court level, is whether any preliminary injunction preventing the law from being implemented, will be issued during the pendency of the litigation.

Then, there is the issue of a remedy on the merits of the suit, if there is some win for the Plaintiffs.

There is little doubt that the core provision of the Amendment, which prohibits public contractors from making contributions in connection with ballot issues funding projects upon which the will bid would be constitutionally valid, standing alone. A similar statute was upheld in Connecticut.

But, a key question is what the remedy should be if the Plaintiffs prevail in having some or all of the rest of the statute declared unconstitutional. A court could invalidate the entire Amendment, could "blue pencil" Amendment 54 by invalidating only "severable" unconstitutional parts of Amendment 54, could interpret the Amendment in a judicially binding way that while not necessary the plain reading of the law gives it a meaning that would be constitutional, or could provide some combination of these remedies.

In sum, absent a consent decree, and the Colorado Attorney General, who is defending the case, has signaled an unwillingness to go that route, the Amendment 54 litigation will probably be with us in Colorado for a long time.

Colorado Amendment 54 amends the state constitution in a way that largely precludes not only public contractor businesses, but relatives of public contractors, public sector unions and people affiliated with non-profits that receive state grant money from financial involvement in electoral politics. It also bans public contractors from making campaign contributions in areas broader than simply ballot issues for projects upon which they intend to make bids.

The primary issue in the case is whether these campaign finance restrictions, which must be narrowly tailored to legitimate governmental issues to be valid despite First Amendment protections for free speech, are constitutional. The nexus between many of Amendment 54's requirements and pay-to-play conduct is very weak. Multiple commentators, including yours truly, suggested before voters even approved Amendment 54 that on the merits, Colorado Amendment 54 appears to go beyond what is permitted by the First Amendment.

Multiple collateral issues are also relevant to the case.

The Plaintiffs, like those in all public law cases, must first show that they have sufficient individualized harm from Amendment 54 to give them standing to bring suit, must establish that the issue is ripe for court resolution in the absence of any enforcement action, and must navigate the question of taking on the statute "on its face" which entitles it to more deferential review, or "as applied" which leads to more searching review of the statute's constitutionality but requires a showing that the Amendment has indeed been applied in a particular way. Many suits challenging the constitutionality of statutes and state constitutional provisions, end up delayed, as the litigation concerning Colorado Amendment 41 gift ban did, or dismissed, over these kinds of general public law issues.

Another issue is the Plaintiffs manage to clear these hurdles at the trial court level, is whether any preliminary injunction preventing the law from being implemented, will be issued during the pendency of the litigation.

Then, there is the issue of a remedy on the merits of the suit, if there is some win for the Plaintiffs.

There is little doubt that the core provision of the Amendment, which prohibits public contractors from making contributions in connection with ballot issues funding projects upon which the will bid would be constitutionally valid, standing alone. A similar statute was upheld in Connecticut.

But, a key question is what the remedy should be if the Plaintiffs prevail in having some or all of the rest of the statute declared unconstitutional. A court could invalidate the entire Amendment, could "blue pencil" Amendment 54 by invalidating only "severable" unconstitutional parts of Amendment 54, could interpret the Amendment in a judicially binding way that while not necessary the plain reading of the law gives it a meaning that would be constitutional, or could provide some combination of these remedies.

In sum, absent a consent decree, and the Colorado Attorney General, who is defending the case, has signaled an unwillingness to go that route, the Amendment 54 litigation will probably be with us in Colorado for a long time.

California Real Estate Prices Back To Earth

The percentage of households that could afford to buy an entry-level home in California stood at 59 percent in the fourth quarter of 2008, compared with 33 percent for the same period a year ago, according to a report released Wednesday [February 18, 2009] by the California Association of Realtors.

The minimum household income needed to purchase an entry-level home at $248,030 in California in the fourth quarter of 2008 was $48,900, based on an adjustable interest rate of 6.02 percent and assuming a 10 percent down payment. The monthly payment including taxes and insurance was $1,630 for the fourth quarter of 2008.

At $48,900, the minimum qualifying income was 42 percent lower than a year earlier when households needed $83,700 to qualify for a loan on an entry-level home. Recent decreases in home prices and mortgage rates have brought affordability into better alignment with income levels of the typical California households, where the median household income is $59,160.

At 76 percent, the high desert region was the most affordable area in the state. The San Luis Obispo County region was the least affordable in the state at 44 percent, followed by the Los Angeles County region at 46 percent.

From here (emphasis added).

Nationally, about two-thirds of Americans are homeowners.

Not all of the fallout from the financial crisis has been bad news. California real estate prices had put home ownership out of reach for tens of millions of people in California and other markets experience housing bubble prices.

When entry level housing costs more than affluent home buyers can afford on terms that are themselves less than conventional, housing prices are higher than the market can bear and a disruptive collapse is inevitable sooner or later. Excessively high housing prices have been an important factor driving migration out of California and impairing its economic growth.

The powerful draw of the American Dream, which includes the notion that middle class families ought to be able to own their own homes, also helps explain the reckless financial arrangements that people entered into in order to cope with the bubble. People were willing to enter into adjustable rate loans that they knew they couldn't pay if the interest rates adjusted up from record low levels, skimp on down payments, and accept very long amortizations or even "interest only" loans, because without the lowest possible monthly payments they simply couldn't buy any home. Borrowers and lenders alike justified these risks, and stopped worrying about traditional underwriting tools like income documentation, because most of these loans were fundamentally "hard money" loans. In other words, the house that served as collateral seemed likely to increase in value so quickly, that foreclosure sales could easily cover the amount of the loan and the bank's foreclosure costs, as long as loan payments were kept current for even a year or two.

After the dramatic collapse in housing prices, would be California home buyers can buy the same home, with a similar or lower payment, with far more reasonable terms and down payment arrangements, from more traditional lenders like commercial banks, thrifts and credit unions, rather than mortgage companies financed with securitized loan sales.

Affordable housing is something that California hasn't had for a long time, and will once again make the state attractive for people wanting to start businesses and find work.

It would, of course, have been better if California hadn't seen a housing bubble in the first place. The collapse of a similar real estate bubble in Japan thrust that country into what was arguably the worst recession in the industrialized world since the Great Depression. Americans can't expect to be held harmless or nearly so from this real estate bubble collapse of comparable proportions.

The collapse of any real estate price bubble, particularly one with a drop of more than 20%, the cushion customarily provided to first mortgage lenders through some combination of a down payment, private mortgage insurance and a second mortgage at a higher rate, means that mortgage lenders lose some of the principal they lent, in addition to failing to earn the anticipated interest payments.

These losses, of course, hurt the financial institutions that are most leveraged, and made the least conservative loans, the worst. We've already seen the subprime and Alt-A lending industries virtually eliminated, banks with weak lending standards like Washington Mutual wiped out, and highly leveraged independent investment banks, which financed the nation's mortgage company based lending, cease to exist.

In the banking industry, the survivors seem to be commercial banks, thrifts and credit unions, particularly those with a local orientation disentangled from national financial markets more than major money center banks, that were conservative in their mortgage underwriting practices during the housing bubble.

Real estate construction is based upon assumptions about real estate prices in the year or two it takes from the time it takes to buy land, get zoning approvals and build new structures, until the time properties are sold, typically with third party financing. When real estate prices are unreasonably high, construction companies build too many buildings. So, the construction industry will probably remain anemic until all of the excess building inventory errected based upon unreasonably high prices is absorbed by economic and population growth. The temporary near demise of this industry, of course, will produce lots of job losses in the construction trades and related industries, and will in turn, weaking spending demand in the economy. It will also put pressure on wages in all industries that people who used to work in the construction trades are able to do, fields that have mostly seen declines in inflation adjusted wages since the 1970s already.

I expect that construction wages will plummet (ironically just as the proportion of the construction workforce that is composed as undocumented immigrations declines greatly as immigrant workers return to their countries of origin, discouraged by poor job prospects), as demand for construction work falls, and that in the face of a dearth of new construction work, that firms offering rennovation work at very competitive prices will spring up. Bids for government construction jobs, which may be the only game left in the industry in many cases, should also become more competitive, easing strained government capital budgets.

Who gets hurt, besides bankers, builders and merchants hurt by a generalized decline in economic demand? The people who bought property at real estate bubble prices and are now upside down on their real estate investments, and the parallel group of people who felt comfortable running up consumer debt based upon high real estate and financial investment values.

In California, which is one of the few places in the country where mortgages on owner-occupied homes are generally non-recourse (i.e. the owners can't be sued for the bank's losses net of the collateral after a foreclosure), homeowners who were swept up into the trend of taking out loans bigger than they could afford, may end up with battered credit records, but will typically lose only their down payments, which were often five percent or less of the purchase price. Some of these homeowners may even secure mortgage modifications in or out of bankrutpcy, and get to keep their homes with reduced loan amounts, lower interest, or more slowly amortized mortgage debts. Others may be able to buy different homes at the current more affordable prices.