A simple summary of where our federal tax dollars go is found

here.

Defense and security: In 2007, some 22 percent of the budget, or $590 billion, went to pay for defense, homeland security, and security-related international activities. . . .

Social Security: Another 21 percent of the budget, or $586 billion, went to Social Security . . . .

Medicare, Medicaid, and SCHIP: Three health insurance programs — Medicare, Medicaid, and the State Children’s Health Insurance Program (SCHIP) — together accounted for 21 percent of the budget in 2007, or $572 billion. . . .

Safety net programs: About 9 percent of the federal budget in 2007, or $254 billion, supported programs that provide aid (other than health insurance or Social Security benefits) to individuals and families facing hardship. . . .

Interest on the national debt: The federal government must make regular interest payments on the money it has borrowed to finance past deficits — that is, on the national debt. In 2007, these interest payments claimed $237 billion, or a little less than 9 percent of the budget. . . .

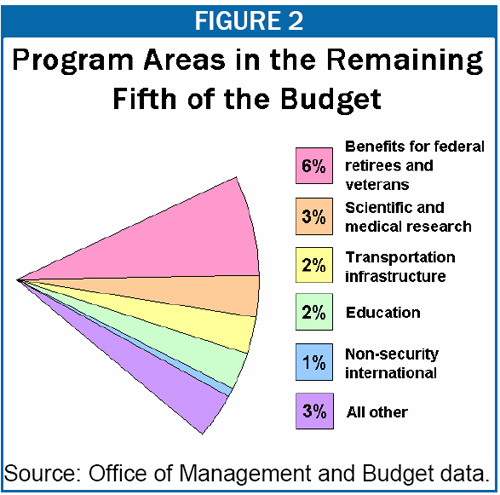

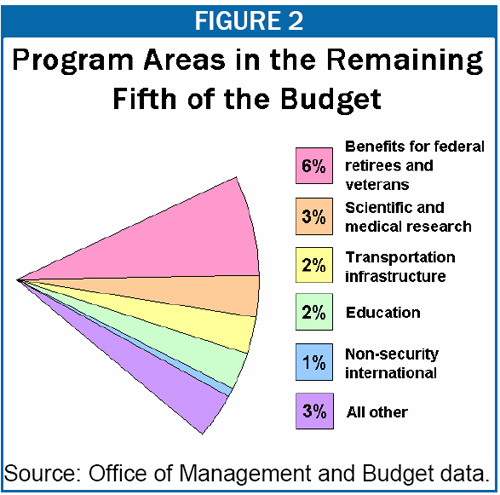

As shown in Figure 2, the remaining 18 percent of federal spending goes to support a wide variety of other public services.

No comments:

Post a Comment