One of the strongest signs that our economy is stagnating is that our big businesses are sitting on hundreds of billions of dollars of cash that they can't figure out anything worthwhile to invest in. Tax incentives explain why that money is being held abroad rather than repatriated. But, it doesn't explain why that money is being held in cash instead of being used for direct foreign investment.

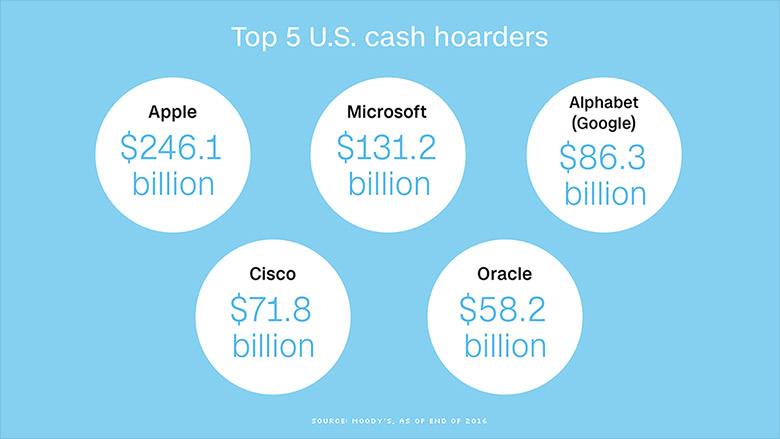

Apple, Google and Microsoft are sitting on a mountain of cash -- and most of it is stashed far away from the taxman. Those three tech behemoths held a total of $464 billion in cash at the end of last year, according to a Moody's report published Wednesday. Apple (AAPL, Tech30) alone had a stunning quarter-trillion dollars of cash thanks to years of gigantic profits and few major acquisitions. That's enough money to buy Netflix (NFLX, Tech30) three times. It's also more cash than what's sitting on the balance sheet of every major industry except tech and health care. All told, non-financial U.S. companies studied by Moody's hoarded $1.84 trillion of cash at the end of last year. That's up 11% from 2015 and nearly two and a half times the 2008 level.

Roughly $1.3 trillion -- 70% of the total -- is being held overseas, where the money isn't subject to U.S. taxes. Apple, Google owner Alphabet (GOOGL, Tech30), Microsoft (MSFT, Tech30), Cisco (CSCO, Tech30) and Oracle (ORCL, Tech30) hold 88% of their cash overseas. Moody's said the tower of money stashed abroad reflects the "negative tax consequences of permanently repatriating money to the U.S." . . .[C]orporations' reluctance to spend that money is holding the recovery back. Cash sitting on the balance sheet is money that isn't being put to work on job-creating investments like new factories. Despite their swelling coffers, capital spending by U.S. companies plunged by 18% last year to $727 billion, according to Moody's. Much of that decline was because of a downturn in the oil industry, which forced energy companies to preserve cash by delaying investments. Spending on dividends, stock buybacks and even acquisitions also declined last year, Moody's said.

No comments:

Post a Comment